No Relationship Between Money Printing and Rupee Depreciation? 💸📉

This may be a controversial topic.

Everything started when our former Central Bank governor stated that “There’s No Relationship between money printing and rupee depreciation”🤡. Tweeps became so arrogant and #SackCabraal , #ArrestCabraal began to trend. Many tweeps specified this as stupid ideology. I also admit that he always tries to blame the previous Yahapalanaya government for the crisis, which is also not so wrong. But beyond politics, even though he is wrong, there’s something for “Takeaways”🤏.

If you are new to this topic, I strongly encourage you to read the previous blog Economic Forecast 💸💱 so you can understand the terms without any hesitations😁.

Quick Note:

Overnight Lending Market : This is a special kind of market. More than a market, this basically acts as a ledger.

Let’s say there’s an Oil distributor company called “LieOC”😅. They are buying supplies from a company called “Ceylon Steal🌚”. After receiving the items, LieOC’s bank releases the amount to the Ceylon Steal’s bank. But these transactions finished immediately relative to LieOC and Ceylon Steals. But not for the banks😈. The data of the above transaction will be recorded in the Overnight Lending Market. Every bank or institution registered to do financial activities under CBSL altogether makes a pool like structure 🎱 in the Overnight lending market. By this structure, all of the “Inter” transactions between institutions ( Who have to pay whom) are recorded in Overnight Lending market ledger🤑. At the end of the fiscal day, there’ll be clearance between institutions including the very small interest rate. There’ll be some institutions with net positive flows as😃 well as some with net negative flows🥲. Net negative entities should pay the amount and net positive receive their amount. This is how the overnight lending market works.😴

Common Misconception

Everyone thinks that commercial banks are lending loans with the deposits of the customers. That concept is partially wrong. Let’s see why.👽

Retail businesses or individuals only withdraw cash from the bank as “Physical Cash”(Comparatively very low of total turnover)👀. The remaining majority of the transactions happening in the economy are mostly within the bank and Bank to Bank. So basically cash doesn't exit the system. You’ll find out why “Banks Don’t Need Your Savings” at the end of the article. 🙆♂️

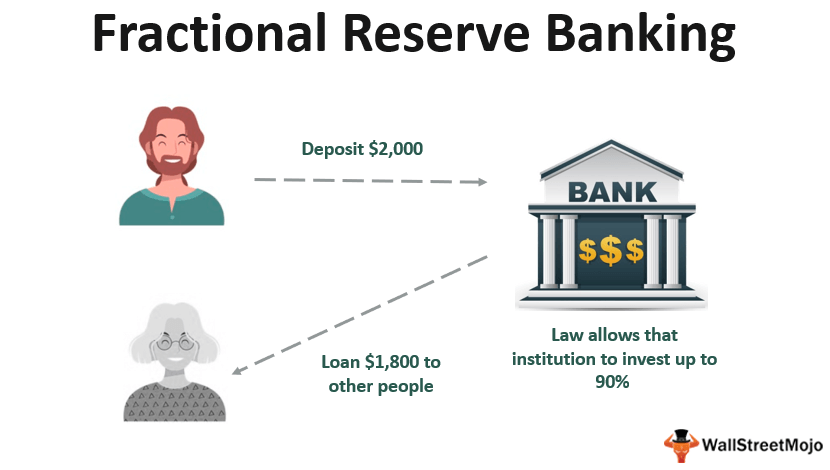

Fractional Reserve Banking

Fractional reserve banking is a system where the Central bank limits the fraction of total cash that can be lent out. In Srilanka, the Statutory Reserve Ratio is 4%. That means, 4% of the total liable money of the banks should be kept in bank vault as cash or in their central bank reserve accounts🚚. (This rate may change)

Ok ok, Let’s brief it. If you deposit Rs.100 in a bank, the bank keeps Rs.4 and lends out the remaining Rs.96 for loans, bonds etc💰. Why? Well, this was initialised to manage sudden huge withdrawals.(But the governments use this to manipulate the economy in modern economy😶).

Let’s take person A as a borrower. Person A applied for a loan and got Rs. 100 000 000 in bank X. He cannot fit the whole amount into his pocket🤓. So, he has to deposit the money in a bank. So, he has deposited the amount into bank Y. Now, Bank Y stores 4% of the amount and lends out the remaining 96% to person B😮💨. Now person B has 96 000 000. He cannot brag about his money by hiring a van😒. So he deposited the amount to Bank Z. Bank Z now has 96 000 000. Bank Z stores 4% of 96 000 000(which is 3 840 000) and lends out 92160000 to person C. 🤑

Finally this is the result with the initial 100 000 000 offered by Bank X;

Person A has 100 000 000

Person B has 96 000 000

Person C has 92 160 000 and so on

This cycle continues until the amount becomes 0. If you do Math, you’ll get an equation as follows, which shows the total new money made by this fractional banking system,

100 000 000*(1/0.04)

That means, N = M*(1/r)

Here,

N = Total amount of new money Injected

M = Money put into monetary base

r = reserve requirements

So, in the above case, the monetary base of 100 000 000 has injected 2 500 000 000. That’s a huge amount to be honest. The system just makth the base cash X25🤯🤯.

This system creates a huge amount of money from nothing (Economists call this as “Creates money from thin air”, lol🤣). To be clear, the amount of money get printed by the CB money printer is nothing when compared to the amount of money created out of thin air by fractional banking system🙃. If the bank runs out of deposits, they’ll postpone the amount they have to pay to the overnight lending market. Borrowers pay more interest than the interest rate of the overnight lending market. So banks don't need to worry. Damn, this is awesome. Isn’t it?😵

Role of Central Bank

You may understand the Central bank’s role here. By adjusting the Statutory Reserve Ratio(r) , CB can influence the economy by limiting the cash flow of the system✌️✌️.

Central Banks also influence the money flow by adjusting the interest rate system. (I will try to explain about interest rates in another blog)🧠👃.

So, Your deposits are a cheaper option for banks to lend money, anyways not necessary 🙂.

You might think, Cabraal is partially right 🙂 Yes he is. In a fractional banking system Inflation is totally accidental. The Central Bank can take measures at their best to prevent inflation. But the fact Inflation is completely unpredictable and boosted by credit worthy borrowers & hyper performance of commercial banks.

See you again with another blog tomorrow 🙃✌️

Comments

Post a Comment