Story of the Stumbled Moon 🌙

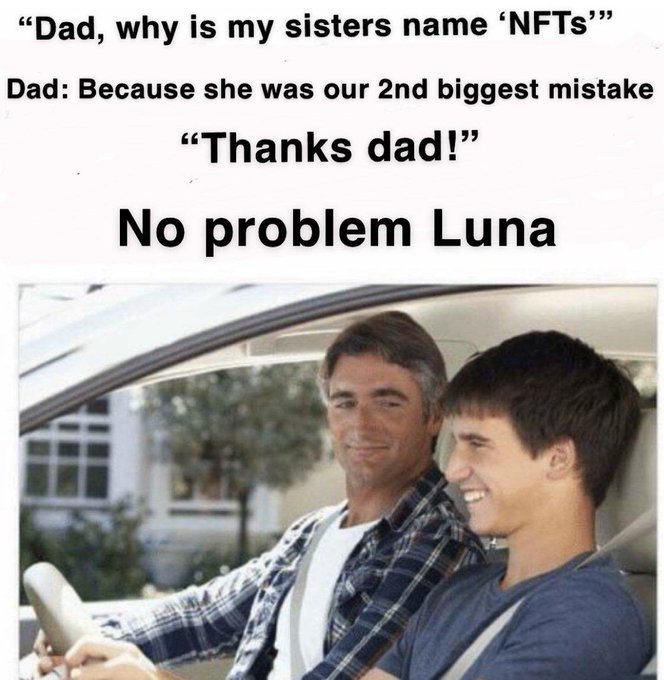

$LUNA ( Latin Name for Moon) 🌙

Was the 6th largest Crypto in the world. If you had Rs.1,000,000.00 worth in Luna on May 5th, you may have less than 3 rupees now🙂. Awesome🚶♂️. This article is all about the things you should consider before funding into Crypto😃.

Aplogies: If you're not familiar with tech or Crypto, you may find it harder to understand.

Story of the Giant

Luna and UST tokens are made by Terraform labs, which was founded by Do Kwan who is a cocky, South Korean, graduated from Stanford and founded Terraform labs in 2018. Unlike a typical startup story, Terraform labs attracted investors’ attention swiftly because of their “Seems to be” low risk and breathtaking business plan🙂. Stakeholders believed this business as the revolution of De-fi. And the concept called Algo Stable coin, which has failed in almost every case in the industry before, has been introduced successfully with a proper design and plan by Terraform Labs. This delivered an illusion of being part of the revolution of the financial system😶🌫️.

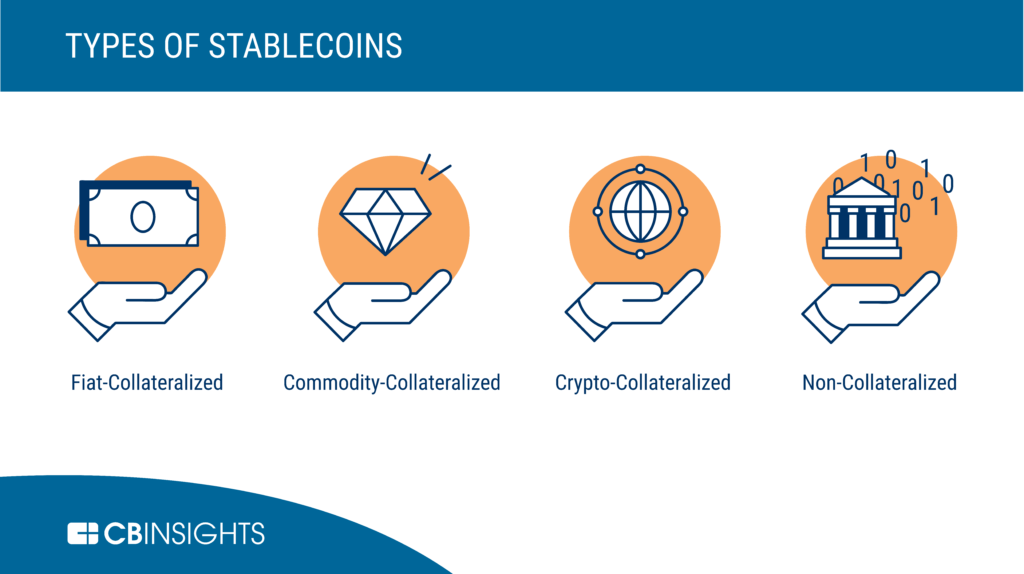

Stable Coins

Stable coins, a type of crypto currency which pegs its value to less volatile collaterals such as US Dollar, gold, diamond etc. So, the de-fi community can use these tokens to protect their total value of their assets from volatility🤠.

As an example; There’s a currency called USDT which was developed and issued by a Hong Kong company called Tether Limited. This currency almost pegs its value to 1 US Dollar💥. That means, for most of the time 1 USDT=1 USD.

This is hosted in both Bitcoin and Etherium networks. This is a centralised currency which uses fiat as the collateral🤜🤛.

Basically acts like a bank. You have to deposit your USD to them and they’ll send you that money worth of USDT. Your USD is still in their liability column. During the withdrawal, you have to send them their USDT and they’ll send your USD back. But the design of UST & Luna in the Terraform network are much different than USDT of Tether Limited🙂.

TerraForm Network

UST & Luna are the currencies which are living in the Terraform network. To purchase UST tokens, first you have to buy Luna somewhere in the off-chain third party exchanges like Binance, Bitflix and Coinbase🤗. Then you have to bring your Luna into the Terraform chain and have to mint UST. That means, you give your $1 worth of Luna into the network and you’ll get one UST in return. Do you need your Luna again? No worries, you can get it back by sending your 1 UST into the network and you’ll get $1 worth of Luna. But note here, that Luna is not less volatile as UST, Luna can fluctuate as other Cryptos❤️🔥.

Why Do People Need UST?

Well, if you are holding UST, you’ll get a reward of 20% p.a. And also UST is being used in multiple platforms like gaming platforms, de-fi insurances and more de-fi based web 3 projects🎮.

The Network

Unlike other stable coins,UST is not using any collateral to peg its value (to $1). It’s completely pegged to $1 by using an arbitrage mechanism. This is quite a smart mechanism 🧠. Let’s see how🕳.

When UST’s price got pulled from $1 to $0.95 by the selling pressure for an instance, it’ll stimulate the arbitrageurs (Mostly bots). Then, arbitrageurs do their job by purchasing UST for $0.95 on off-chain and send them into the Terraform network(on-chain), which offers them $1 worth of Luna. Here, profit is $0.05 for the arbitrageurs. During the counter-case, due to buying pressure the order book became thick and UST value pulled up to $1.05. So, those who’ve minted 1 UST for $1 start to sell them in order to get the profit of $0.05. This selling pressure brings the order book balanced and the UST will be back to its expected value $1. Most of these arbitrageurs activities are being done by the bots and no need to worry about that. So, using this smart method Terraform keeps the stable coin stable by pegging its value to $1. This is totally done by algorithms and here no collateral has been used like the USDT case.

Seems legit, so what’s the problem here?

There’s a problem here, if the total market cap of Luna < market cap of UST, the network cannot mint UST for all. This was specified as the weakness of Luna network by many blockchain experts and TerraForm labs purchased $1 billion worth of bitcoin to fill its reserves, so they can pay in bitcoin to the excess minters👀.

The Crash

No one has any idea how this crash sparked. But there’s a conspiracy theory related to some twitter bets. So, everything started with a large amount of UST selling in off chain markets✍️. So as always, arbitrageurs started to do their thing. Buying UST and burning them for Luna. But this time due to high selling pressure on UST order books, people started to sell the Luna in offchain markets🦿. This is where the death spiral formed.

Due to high selling pressure on UST, UST lost its peg and reached $0.7 is the scenario which fueled the Luna sellings in off chain markets👁. So, Luna started to lose its value.

People also panicked that, if Luna’s market cap fell behind UST’s, the network may find it hard to compromise. So, this again fueled the burning Luna selling and news of UST losing its peg fueled the burning of UST selling. Also more people tried their best to come out of this network with a profit. So, they burned their UST and minted Luna😉. But this time due to selling pressure Luna is already losing its value. So, the network system has to print more Luna for 1 UST than what it has printed before. This sparked the hyperinflation of Luna and this again made the selling pressure of Luna to the top. This cycle continues again and again, so at a time, they have to give users Bitcoins, which is unrelated to their network🙅.

This made a pullback in Bitcoin price too🙂.

As I've said before, this repetitive process continued for days and wiped out $45 Billion dollars from existence in a finger tip as losing 99.99% of Luna's value & UST lost its peg👾. The price of Luna had fallen from $80 to almost $0. Well, technically $0.0001426🤏.

Takeaways

Crypto environment is a highly volatile environment. So, research about the algorithms and design of the system carefully before getting in🤚. This type of situation can probably happen to USDT too. I’ll try to cover it in another blog. Thanks All…🙂

Comments

Post a Comment