Where We All Heading Financially?

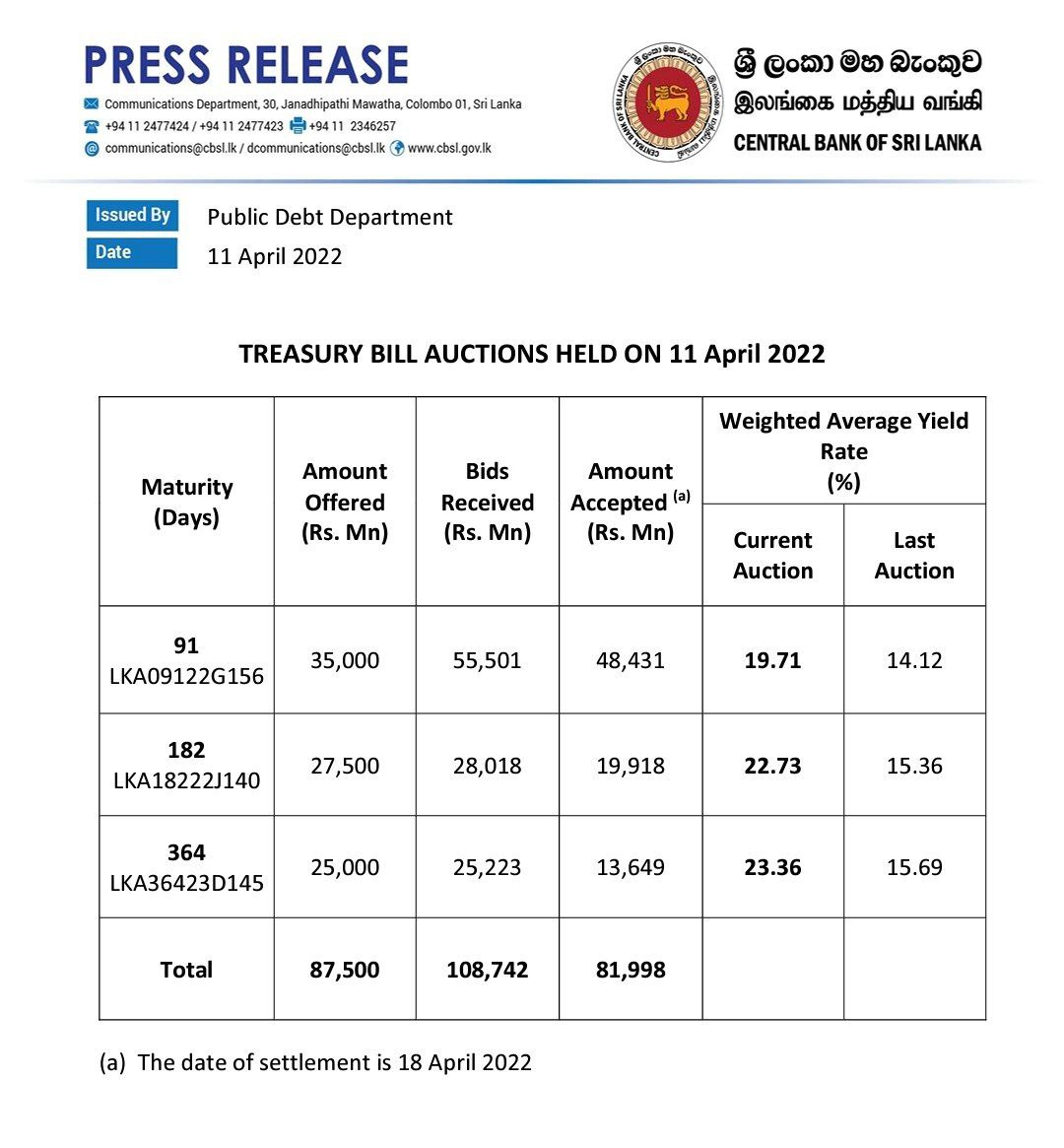

On 11/ 04/ 2022 Central bank has issued the T-bill interest rates as follows.

What is t-bill? What is interest rates? How can it affect our economy? How it's gonna affect your life? What are the cons and pros?

Stick with this artical till the end, so you'll get the answers.

What is Treasurery bill?

Treasurery bill which is shortly called as T-bill, is a kind of liability of a country. Simply, when a country needs credit for some short term investments or to run, the goverment borrows money from different entities. Mostly banks. As a reward, the government pays a specific interest rate to them for the amount received.

You may ask how it can affect our economy?, comming to the point. In a crisis like ours, a country needs money to run.

Take our country as an example. Now we have 3 choices in these critical times.

1. Money printing.

2. Asking for credit lines from another countries.

3. Using the money from the treasurery.

Money Printing is bad, we all know. But money printing is the only way that a country can sustain it's local needs and that's the practice which prevent It's local economy from collapsing. Of cause, for a short term.

Asking loans from friendly countries also helps a country to increase the gradient of the economy. But our country may go through some constrains applied by the lending

country. These constrains may affect the free foreign relationship, national security, closed economic policies of the borrower country.

The last one is issuing T-bills. T-bills are issued by the Central bank via auction to different entities contains banks, trusts, individuals (even you 😉) and other financial institutions.

Yeah, we can imagine the t-bill auction simply like the scnerio follows:

*Location: auction platform*

Central bank(CB): Hey folks, welcome to the T-bill auction. I need a hundred rupees. Can you guys offer me that? I'll payback in a year.

Entity 1: Sure dude. But I want 20% in return.

C B: Eww, I don't think I can pay you such a high interest. Next

Entity 2: Hmm, I can finish for 15%.

C B: Seems obvious. (Look at the crowd) Is there anyone here to offer your bro cheeper than 15%?

CB: 🥲

Entity 3: Sorry to say that, but we've already researched. You've broken now. In high debt, increasing inflation, depreciation of foreign reserves etc . So you've no other choice. You have to borrow from us only.

CB: Yea, yea. Obvious move 😏. Ok, I'm accepting your demand. You buy these bills and i'll give you 15% + capital after a year. Happy?

* Majority happy, but some seems panicking. After the read, tell me who are the ones panicked, ofc in the comment section * 😌

This is what happens in a t-bill auction shortly.

So, now banks got a great opportunity to make freemoney. But they need capital. So all banks will raise their interest rates in order to encourage the public to save their money. So, banks can make more money out of it. Anyways, they offer you less interest rate than the treasurery. So they make the remaining as their profit. (Yeah, as a former bank cashier, I can confirm that "Banks are always the winners"😁)

These interest rate hikes affects the whole economy under both positive also the negative ways.

Example: If saving interest rate increased, banks have to increase the interest rates for the loans too. So, let's assume you have to apply for a housing loan, but now Interest rates increased. However, from another point of view, you'll postpone your construction works, so no need to import cement, furnitures, paints and other stuffs. So the country can secure the dollers. That's not fair,isn't it? 😏😂

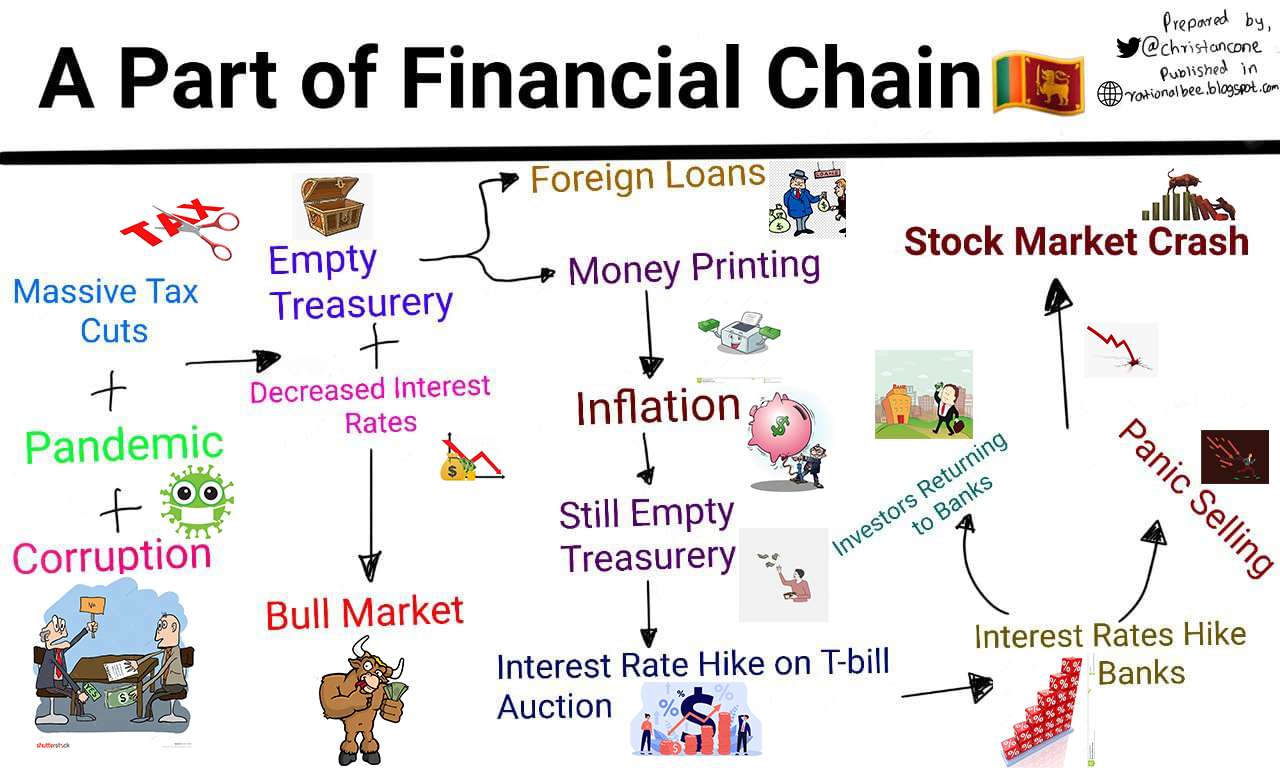

Like the above, we can practically get the relationships between each and every factors in economics. However, that will be a long blog If I explain everything. So, I've prepared a kind of chart to explain how some common economic factors twisted with each.

(Thank me later 😁😂)

*

2. Crypto Currencies: To escape from LKR inflation, what we should do is to turn our currency into another strong one. Swaping LKR into other fiat currencies like USD, Euro, Pounds requires taxes, commisions, bank procedures, paperwork involvements and more. But swaping LKR into crypto is easy and promising. Analysing cryptos wisely and investing into the right and promising one may produce a considerable capital gains in a long run. If you want to stay away from the risks cause by them, it's better to stick with stable coins such as USDT and BUSD. These are the cryptos which values mostly sticks with USD. So, it's safe to jump into this.

3. Commodities: You can buy gold, silver, real estate, vehicles, even canned fishes. (Not a risk free way though). Gold prices will fall is a myth. In case the gold price drops, can it reach the 10 year past price? Never. And we are not on the dip of the inflation either. Economists expects USD value may reach more than 400 in LKR. And also we are going to take assistant from IMF too. So it's better to be ready for the worst case scnerio 🥲

4. Stock Market: The controversial topic ever in Srilanka. 😂 Yeah, so many manipulations, political influence, whale's influence, stock broker's manipulations, etc etc etc. So, I don't recommend this to anyone those who are not familier with this. But market can be our side too. But this is not much scary though (voice of a man who lost his 35% lol). Even though Colombo Stock Exchange is now going through some bad influence now, each and every value company shares are on sale now. Educate yourself, teach yourself some corporate financials, read some company annual report and take decisions accordingly. Like everything, the uncertainity is the major risk here. You know, throned fishes are also the tastiest ones 😉🥲

5. Flee: Some of you may disagree with this statement. But as your well-wisher, this isn't a bad idea at all. Do you have enough money to study abroad? or maybe skill migration, via private agencies, sponsorship or anything. JUST GET AWAY. Do you think you can do more than this? you deserves better? Think rationally. Why should you really waste your only life in this country for non sense? Just flee. You really love your country and send Dollers to your loved ones or charity. At least Lanka may get something to maintain it's foreign reserves and protect your people from powercuts and fuel shortage. And also have to mention, western countries are facing a mass labour crisis while we are unemployed here. Think wisely.

Last but not least, try to get away from Ponzi/ pyramid schemes. There are suddenly many scams germinated in Srilanka targeting the people mostly affected by inflation. So try not to get involved in those. Those agents will talk like hunny and also will submit tons of fake proves. Be alert.

Have a good one........................

switchToDoraMode():

Can you see the phase we are currently in? 😁

terminateDoraMode():

*

Ok, adjust your seats. Now we are going to crave how we can make ourselves survive in these unusual times.

We are far away from the hyper inflation, but also not near the healthy inflation rate. So, no matter how secure our fiat assets are, the value of our LKR is falling. So, it's better to be cautious. Here are some ways to keep ourselves away from the inflation other than stop spending, lol 😂

1. Fixed Deposits: The best way I can recommend you to almost float(Not completely) through the inflation era. (Most of us are already familiar with this). But specially in this high interest paying times, just make sure your time deposits got renewed as well. Other than depositing our money in the government banks, there are many registered private financial institution who pays a bit more than the standard bank interest rate. But also make sure that those institutions have been registered under Central bank of Srilanka.

Can you see the phase we are currently in? 😁

terminateDoraMode():

*

Ok, adjust your seats. Now we are going to crave how we can make ourselves survive in these unusual times.

We are far away from the hyper inflation, but also not near the healthy inflation rate. So, no matter how secure our fiat assets are, the value of our LKR is falling. So, it's better to be cautious. Here are some ways to keep ourselves away from the inflation other than stop spending, lol 😂

1. Fixed Deposits: The best way I can recommend you to almost float(Not completely) through the inflation era. (Most of us are already familiar with this). But specially in this high interest paying times, just make sure your time deposits got renewed as well. Other than depositing our money in the government banks, there are many registered private financial institution who pays a bit more than the standard bank interest rate. But also make sure that those institutions have been registered under Central bank of Srilanka.

2. Crypto Currencies: To escape from LKR inflation, what we should do is to turn our currency into another strong one. Swaping LKR into other fiat currencies like USD, Euro, Pounds requires taxes, commisions, bank procedures, paperwork involvements and more. But swaping LKR into crypto is easy and promising. Analysing cryptos wisely and investing into the right and promising one may produce a considerable capital gains in a long run. If you want to stay away from the risks cause by them, it's better to stick with stable coins such as USDT and BUSD. These are the cryptos which values mostly sticks with USD. So, it's safe to jump into this.

3. Commodities: You can buy gold, silver, real estate, vehicles, even canned fishes. (Not a risk free way though). Gold prices will fall is a myth. In case the gold price drops, can it reach the 10 year past price? Never. And we are not on the dip of the inflation either. Economists expects USD value may reach more than 400 in LKR. And also we are going to take assistant from IMF too. So it's better to be ready for the worst case scnerio 🥲

4. Stock Market: The controversial topic ever in Srilanka. 😂 Yeah, so many manipulations, political influence, whale's influence, stock broker's manipulations, etc etc etc. So, I don't recommend this to anyone those who are not familier with this. But market can be our side too. But this is not much scary though (voice of a man who lost his 35% lol). Even though Colombo Stock Exchange is now going through some bad influence now, each and every value company shares are on sale now. Educate yourself, teach yourself some corporate financials, read some company annual report and take decisions accordingly. Like everything, the uncertainity is the major risk here. You know, throned fishes are also the tastiest ones 😉🥲

5. Flee: Some of you may disagree with this statement. But as your well-wisher, this isn't a bad idea at all. Do you have enough money to study abroad? or maybe skill migration, via private agencies, sponsorship or anything. JUST GET AWAY. Do you think you can do more than this? you deserves better? Think rationally. Why should you really waste your only life in this country for non sense? Just flee. You really love your country and send Dollers to your loved ones or charity. At least Lanka may get something to maintain it's foreign reserves and protect your people from powercuts and fuel shortage. And also have to mention, western countries are facing a mass labour crisis while we are unemployed here. Think wisely.

Last but not least, try to get away from Ponzi/ pyramid schemes. There are suddenly many scams germinated in Srilanka targeting the people mostly affected by inflation. So try not to get involved in those. Those agents will talk like hunny and also will submit tons of fake proves. Be alert.

Have a good one........................

🥳🥳future economist 🤗🤗🤗👏👏

ReplyDelete😂😂 Thanks, lol 😊

DeleteGood understanding about how decisions are made, how markets work, how rules affect outcomes, and how economic forces drive social systems will equip people to make better decisions and solve more problems.

ReplyDeleteThank you very much for informate us 🤗🤗

Thank You so much for giving a recap voluntarily 😁😍. And also thankyou so much for the visit & your input ☺️☺️

Delete